Five Truths and Misconceptions about Social Media in China

It’s supposed to teach us not to believe everything you hear, but when scaling digital in the Asian market it’s more important than ever not to let misconceptions hold sway.

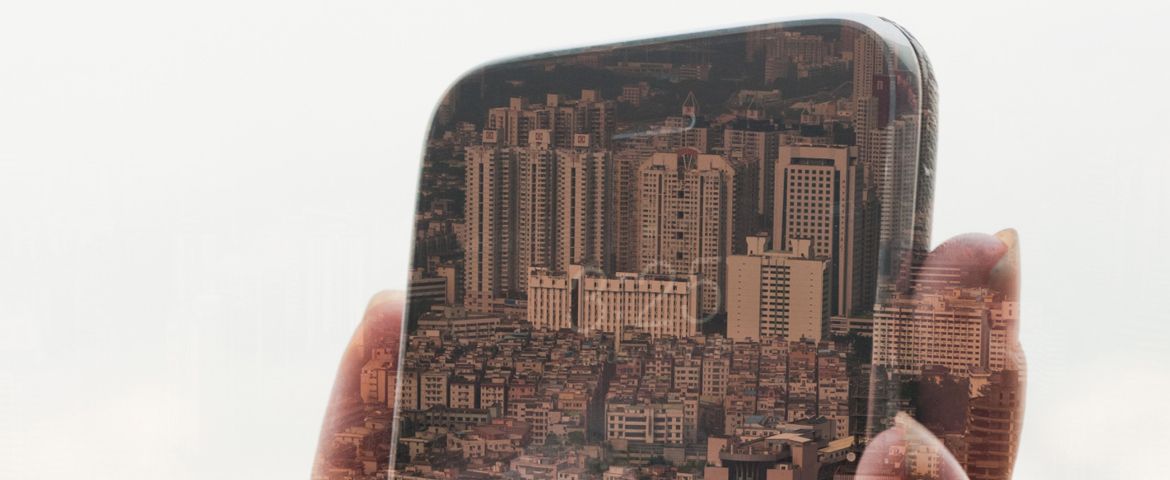

China’s inexorable rise is well documented. It’s not just the world’s fastest growing economy, it’s also home to the world’s fastest growing online population with over 649m users, outnumbering the entire US population two to one.

Though it has similarities, the Chinese social media market is quite different from that in the West. Here are five ways the Chinese social media market differs.

Being relative latecomers to the smartphone market, you might assume that connected mobile adoption in China lags behind the West. You’d be wrong.

Mobile in China is huge. In the past few years, China has been going through an explosive internet adoption period and mobile has played a key role in getting people online.

Today, more people access the internet from a mobile device than a PC and of the 649m population online, 557m of those users (80%) are on mobile.

What do these mobile users do online? They chat, review products and shop… a lot!

Mobile shoppers numbered 205m in China as of June 2014, growing 42% in just six months. The portion of mobile internet users who shopped online also rose from 28.9% to just under 40%.

All of this means that China is becoming a 'one screen nation', with its citizens preferring to access media on their mobiles more than any other medium.

Globally, this is fairly unique. Even in the US, people still spend as much time with their TV sets as surfing the web on mobile.

For more information, n dowload our State of Mobile Marketing in China report.

Instant messaging

Stating the obvious, the growth of IM platforms goes hand in hand with the growth of mobile. And its growth with serious clout, perhaps best evidenced by Facebook’s recent $19bn acquisition of IM super-platform Whatsapp.

Whatsapp might be riding high with over 700m active users but China’s WeChat is still the go-to IM platform in Asia, so popular in fact that Kik’s CEO, Ted Livington, has even stated that his company wants “to be the WeChat of the West.”

So what’s the difference? Whatsapp and WeChat might both be instant messengers but that’s where the similarities start and end.

WeChat is also a social network, a social media app and an extendable transactional platform. It gives its users the opportunity to shop, talk to brands, order taxis (its ‘Didi Dache’ service is essentially China’s UBER) and read the news.

Western IM companies are taking note. Tango has added a shopping tab to its service offering and Snapchat has recently introduced news section, ‘Discover.’

Successful brand integration with WeChat is more fully explained in David Moth’s post, but take it as read that WeChat represents the future of instant communication in the West.

Channels

Though you might not be able to access platforms like Facebook and Twitter, or watch videos of grumpy cats on YouTube in China, that doesn’t mean there isn’t a vast, comparable and thriving social media network over there.

In fact China has developed an entirely separate, thriving social ecosystem from the rest of the world.

Social media platforms in the West are relatively clear cut, with fairly little competition. LinkedIn is the sole option for building work networks, Facebook is largely for friends and family, YouTube for sharing and watching content from strangers around the world, but China does things differently.

For one thing there’s plenty of competition and for another, while Western platforms are largely aimed at connecting people who already know each other, Chinese platforms were initially popularized by enabling anonymous friendships.

It’s opportunities to connect with people who have similar interests and opinions that tend to drive most social platforms in China.

The Twitter of China, Sina Weibo, has more than double the amount of users as Twitter.

The Facebook of China is Renren. It mainly appeals to China’s college-educated citizens (though it has been declining in recent years).

The YouTube of China is Youku Tudou.

And, as previously mentioned, WeChat is huge.

On top of those platforms there’s also over 800m active users on QQ, 600m+ on blogging site, Qzone, millions more on Tianya and plenty of other channels besides, all interest-driven and collectively starting to replace traditional news media for many users.

With so many channels and such a huge opportunity to engage with consumers, if your brand has no presence on any of them, then consider yourself practically invisible in China.

Assuming that video consumption in China is similar to that in the West is also a mistake. To start with, the channels themselves work in a completely different way.

Youku Tudou differs greatly to YouTube in that it’s known for longer, more in-depth videos. This works for the Chinese market. Its 40m weekly unique users spend, on average, over an hour a day on the site. The amount of time that people spend on YouTube is around 25 mins.

YouTube is currently testing the water and dabbling with original content. Youku is far beyond that stage. In March it announced that it was doubling its original content budget to $98m, and more brands than ever are curating content, advertising and engaging customers with the video giant.

It’s not just China that’s watching Youku. It’s the world.

Ecommerce

In the West, Black Friday and Cyber Monday are a big deal. You might assume they’re popular in China as well. They aren’t.

It would be absurd to say that a $3.5bn spend across two days last year is small change, but when you compare it to China’s Singles Day, which last year reached the astronomical heights of $9.34bn in sales, it pales in comparison. And this figure is only set to grow.

Singles Day really highlights the power of the internet in China. The country with 90% internet penetration is obsessed with surfing the web. China is more than comfortable communicating with brands, and it loves buying from them.

In 2014, Singles Day also became truly mobile-first, with 42.6% of sales via mobile. And mobile shopping is inevitably social.

JD.com, China’s largest personal-electronics e-tailer, is one example of a brand that has leveraged its partnership to make the purchase experience run smoothly within WeChat and QQ, which resulted in staggering conversions.

For more information, download our report The State of Ecommerce in China.

Today, understanding how China’s social ecosystem works is fundamental to driving success in that market. Chinese consumers have embraced the digital world and they expect companies to do the same.

Understanding the customer decision journey is critical for brands to be effective in every market and a localized, targeted approach is the best way to win hearts and minds, whether your company is from China, the US or anywhere else.

China Marketing Agency

-

China All-media Marketing

Beyond Summits Ltd is a leading all-media China marketing agency, offering one-stop total marketing solutions.

-

CROSS-BORDER MARKETING & GLOBAL MARKETING

Helping you connect your brands with international consumers & clients.

-

CHINA DIGITAL MARKETING, SOCIAL MARKETING & MOBILE MARKETING

We’re a leading digital, social and mobile marketing agency in China.

-

CHINA ADVERTISING & MEDIA BUYING

As the leading advertising agency, offering professional services of global media buying, advertising creative and production.

-

DESTINATION MARKETING & DESTINATION BRANDING

Providing professional services of destination marketing & branding to both international and China domestic destinations

-

MICE

We offer MICE services from venue finding, hotel accommodation to the complete management of your event.

-

Event & PR

We offer comprehensive services of online and offline event, EPR and TPR.

-

China Marketing Consultant

Providing Chinese consumer insight, China market research and China marketing strategy consulting services